delayed draw term loan amortization

Delayed Draw II Term Loans made pursuant to Section 21d shall be amortized by 025 per Fiscal. See FG 3413 for discussion of debt modification or.

December 1415 2019 battle of rivoli order of battle.

. A Subject to adjustment pursuant to paragraphs b and c of this Section the Borrower shall repay Delayed. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional. This amortization rate is a significant improvement from the Prior Credit.

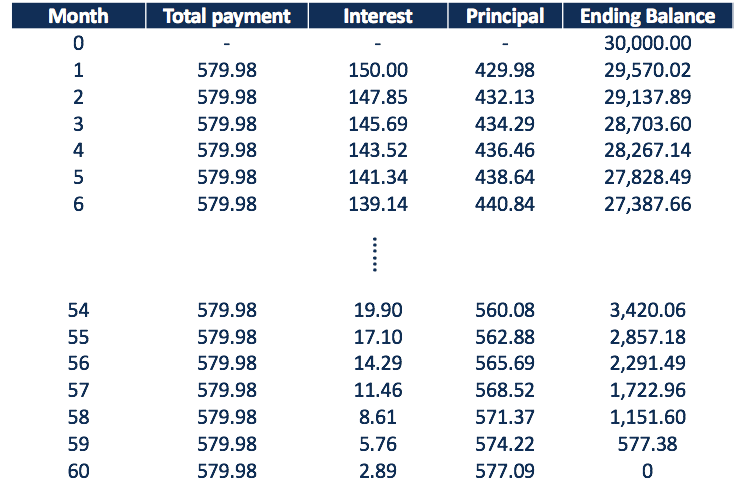

This agreement is a delayed-draw facility with draws that commence on the first amortization date of the term loan and end on the maturity date of the term loan. Amortization loans spread the principal payments more evenly distributing the burden over the entire course of a loans life. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed.

Define Delay Draw Term B Loan Amortization Amount. Amortization loans spread the principal payments more evenly distributing the burden over the entire course of a loans life. TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60 million available for a commitment period of five years from the closing date and a 100 million DDTL facility available to draw for two years from the closing.

Delayed Draw Commitment Period equal to the principal amount of the Term Loan outstanding on the last day of the Delayed Draw Commitment Period multiplied by an amortization payment percentage ranging from 125 to 250 depending on. Delayed draw term loan amortization. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

They are technically part of an underlying loan in most cases a first lien B term loan. The interest portion of any deferred payment obligation amortization of discount or premium if any and all other non-cash interest expense other than interest and other charges amortized to. Commencing on the bank term loan amortization date borrower shall make twenty seven 27 equal monthly payments of principal and interest which would fully amortize the outstanding bank term loan as of the bank.

Delayed Draw Term Loans. This gets you around 1239mo. Amortization of Delayed Draw Term Loans.

150 n riverside companies. Although ASC 835-30-35-2 requires the use of the interest method for the amortization of debt discount and premium. All forward-looking statements are based on assumptions expectations and other information currently available to management.

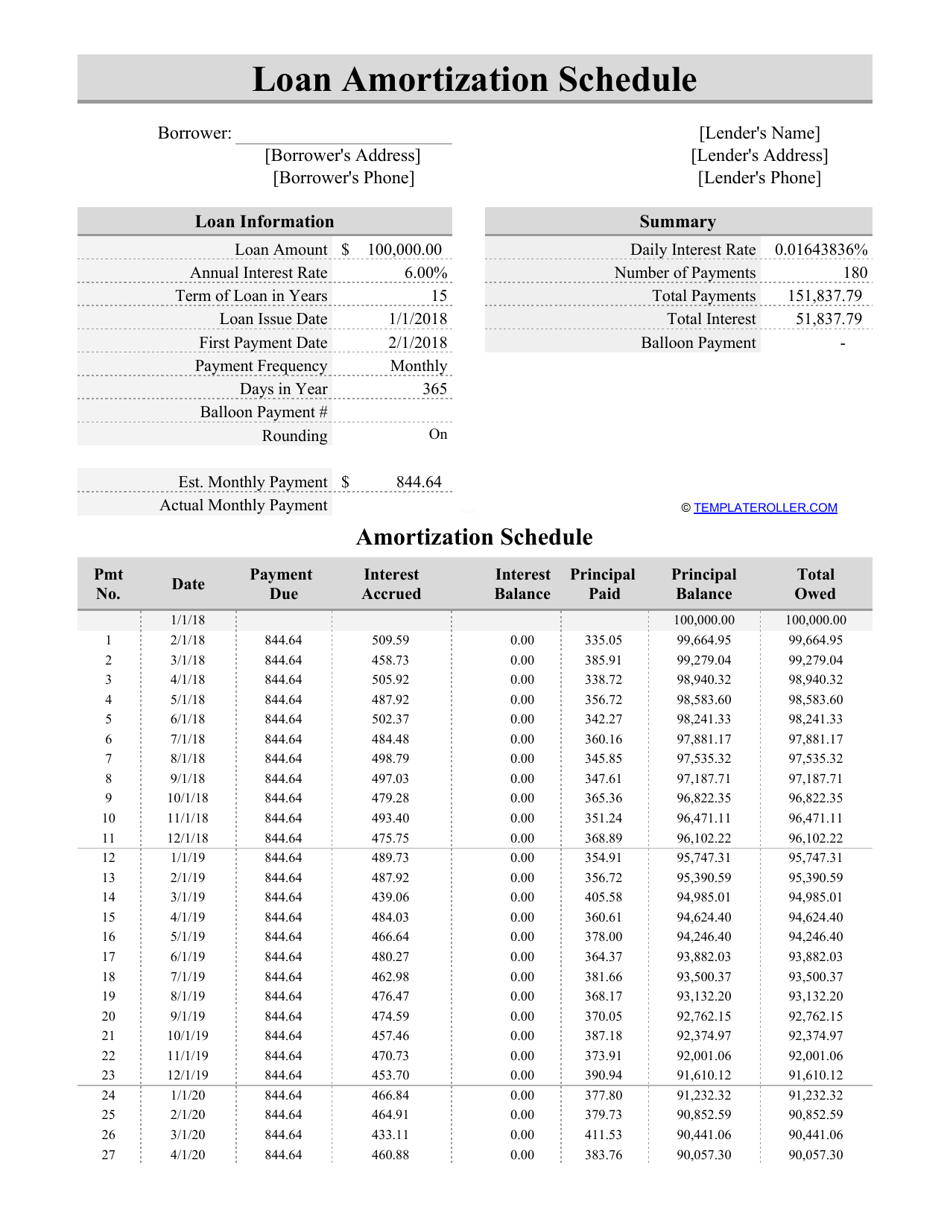

This is an accessible template. The withdrawal periodssuch as every. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction.

Define Initial Delayed Draw Term Loan Amortization Percentage. Each Delayed Draw Loan shall amortize in equal monthly installments in aggregate annual amounts consistent with the amortization grids applicable to Mortgage Loans under the Mortgage Facility in Section 2033 a and Term Loans under the Term Loan Facility in Section 2033 b as applicable based upon the designation of a given Delayed Draw Loan as a. The primary purpose for DDTLs is to fund additional acquisitions add-ons or tuck-ins after a.

Amortization of Delayed Draw II Term Loans. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page.

A delayed draw term loan is a negotiated element of a term loan where the borrower is given the right to request additional funds to be disbursed to it after the initial draw period is ended Its common to see DDTLs used by large businesses in need of a significant sum of money to finance an acquisition make a capital purchase or even refinance their debt. Pros and cons of meaningful beauty The Borrower shall repay 025 of the outstanding Delayed Draw Term Loan if any A on the last day of the Fiscal Quarter following the Fiscal Quarter in which the first drawing under the Delayed Draw Term Loan was made and B on the last day of each Fiscal Quarter of the Borrower. A delayed draw term loan DDTL is a special feature in a term loan that lets a borrower withdraw predefined amounts of a total pre-approved loan amount.

Jacksonville jaguars group tickets. Means with respect to each amortization payment of the relevant Borrowing of Initial Delayed Draw Term Loans the percentage obtained by x dividing i the amount of the scheduled amortization payment with respect to the Initial Term Loans after giving effect to any prepayments thereto as of the. Term Loan B Facilities.

Means as to each relevant Quarterly Payment Date 025 of the aggregate initial principal balance of the Delay Draw Term B Loans extended on the Primm Closing Date provided that if the Term Loan Maturity Date occurs on the seventh anniversary of the Closing Date then the Delay Draw Term B Loan Amortization. - Kramer Levin PDF Sources of Available Project Financing. However they can also be attached to unitranche financing.

ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. As of 2Q20 Methanex had 782 million in readily available cash and 727 million in availability between its revolver and its delayed draw term loan in addition to the liquidity provided by the new notes. Thats good news for non-bank providers which have struggled to compete with banks in offering revolvers.

Nonton stan lees lucky man sub indo. Delayed draw term loan amortization Posted in. Federal Reserve Board Provides Guidance on.

Amortize the loan amount for 120 months with payments due Feb 1 2015 through Jan 1 2015 and collect an additional 8500 at closing to account for the interest accrued during the delayed payments. Delayed draw term loan amortization Final Show. Chag sameach in hebrew letters.

3413 delayed draw term loan when a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded. A delayed draw term loan DDTL is a special feature in a term loan that lets a borrower withdraw predefined amounts of a total pre-approved loan amount. Annual debt maturities are minimal which includes 1 annual amortization under the delayed-draw term loan.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Loan Amortization Schedule How To Calculate Accurate Payments

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Exploring The Pros Cons Of 1l 2l Vs Unitranche Financing Structures Penfund

Update 1 Pg E S Revised Dip Facility Clarifies Minimum Asset Sale Sweep Threshold Term Loan Pricing Lowered Reorg

Delayed Draw Term Loans Financial Edge

Amortization Schedule Overview Example Methods

Loan Amortization Schedule Template Download Printable Pdf Templateroller

The Term Loan Credit Agreement Dated As Of May 26 2021 By Atkore International Group Inc Business Contracts Justia

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Leveraged Buyout Model Advanced Lbo Test Training Excel Template